Introduction

In an era of increasing digital transactions, financial security has become a top priority for individuals and businesses. With cyber threats, fraud, and unauthorized access posing significant risks, safeguarding your money requires advanced protection mechanisms. One such solution is Safecard Money Protection, a cutting-edge financial security system designed to enhance the safety of transactions and protect users from potential financial threats.

This article delves deep into the features, benefits, and implementation of Safecard Money Protection, ensuring you have all the necessary information to make an informed decision about your financial safety.

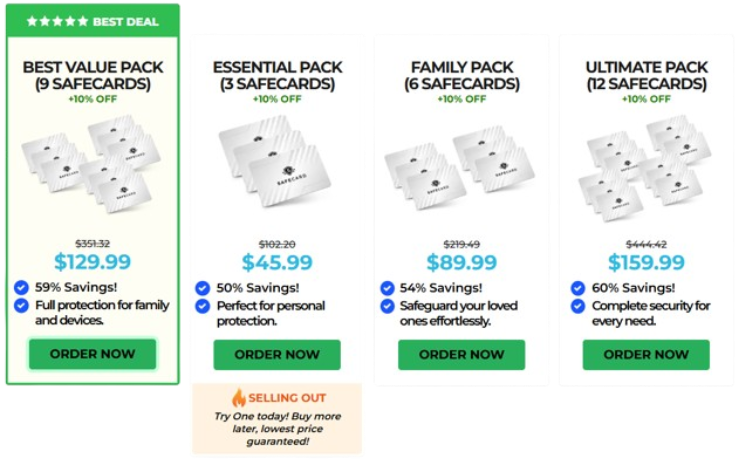

Exclusive Offer – Get Safecard Money Protection for an unbelievable low price today!

What is Safecard Money Protection?

Safecard Money Protection is a financial security solution aimed at protecting users from fraudulent activities, unauthorized transactions, and potential breaches of sensitive financial data. It incorporates advanced encryption technologies, fraud detection mechanisms, and real-time alerts to ensure that your funds remain secure at all times.

Key Features of Safecard Money Protection

- Real-Time Transaction Monitoring

- Tracks all transactions to identify any suspicious activity.

- Sends immediate alerts in case of unusual spending patterns or unauthorized access.

- Multi-Layered Security

- Uses multi-factor authentication (MFA) to verify user identity.

- Employs biometric security, such as fingerprint and facial recognition, for added protection.

- Fraud Prevention Technology

- Implements AI-driven fraud detection algorithms.

- Blocks fraudulent transactions before they are processed.

- Card Locking Mechanism

- Allows users to temporarily lock their card if misplaced or lost.

- Instantly reactivates upon verification.

- End-to-End Encryption

- Ensures secure transmission of financial data between parties.

- Prevents interception of sensitive banking information.

- 24/7 Customer Support

- Offers round-the-clock assistance in case of security breaches or financial concerns.

- Expense Tracking and Budgeting Tools

- Provides users with insights into their spending habits.

- Helps users set limits to prevent overspending and ensure better financial management.

(Huge Savings) Click Here To Get Safecard Money Protection For The Best Price Today!

How Safecard Money Protection Works

Safecard Money Protection operates by continuously monitoring financial transactions in real time. When a transaction is initiated, it undergoes a series of security checks, including:

- Identity Verification: Ensuring that the user initiating the transaction is legitimate through MFA and biometric authentication.

- Transaction Analysis: Evaluating spending behavior to detect anomalies or suspicious patterns.

- Fraud Detection: Using AI and machine learning to predict and prevent fraudulent activities.

- User Notification: Sending alerts and notifications in case of suspicious transactions.

- Actionable Security Measures: Allowing users to block or approve transactions instantly via a mobile app.

Benefits of Using Safecard Money Protection

1. Enhanced Security

With its multi-layered security system, Safecard Money Protection significantly reduces the risk of financial fraud, unauthorized transactions, and data breaches.

2. Peace of Mind

Users can feel confident knowing that their funds are protected against cyber threats and fraud.

3. Convenience and Control

The ability to lock and unlock a card, monitor transactions, and receive real-time alerts ensures greater control over financial activities.

4. Protection Against Identity Theft

With biometric authentication and encrypted transactions, users are safeguarded against identity theft and financial scams.

5. Budgeting and Financial Planning

The expense tracking tools assist in maintaining financial discipline and achieving savings goals.

(Flash Sale) Purchase Safecard Money Protection For The Lowest Prices!

How to Implement Safecard Money Protection

1. Register for an Account

Users need to sign up with a financial institution that offers Safecard Money Protection.

2. Activate Security Features

Enable biometric authentication, MFA, and real-time transaction monitoring.

3. Customize Alerts and Notifications

Set up personalized alerts for different types of transactions to stay informed about account activity.

4. Utilize Fraud Prevention Tools

Regularly check account statements and use budgeting tools to track spending habits.

5. Stay Updated with Security Enhancements

Keep your financial security software updated to benefit from the latest security advancements.

(ONLINE SALE) Get Safecard Money Protection For The Lowest Price!

Conclusion

In a world where financial security threats continue to evolve, adopting Safecard Money Protection is a smart move for individuals and businesses alike. Its robust security measures, real-time monitoring, and fraud prevention capabilities make it a reliable choice for those looking to safeguard their money and maintain control over their finances.

By implementing Safecard Money Protection, users not only enhance their financial security but also gain peace of mind, knowing that their funds are protected against unauthorized access and fraudulent activities. As digital transactions become more prevalent, ensuring top-tier security solutions like Safecard Money Protection is no longer an option—it is a necessity.