Credifence Card Protection Reviews: Comprehensive Guide, Benefits, and Why You Need It

In today’s world of rapid digital transactions and global connectivity, financial fraud has become increasingly sophisticated. Credit and debit cards, though convenient, are also vulnerable to theft, misuse, and cybercrime. Every year, millions of consumers across the globe become victims of card fraud, losing both money and peace of mind. In response, specialized card protection services like Credifence Card Protection have emerged as vital shields against such threats.

This article explores Credifence Card Protection in depth, covering its features, benefits, importance, and practical tips on safeguarding your finances.

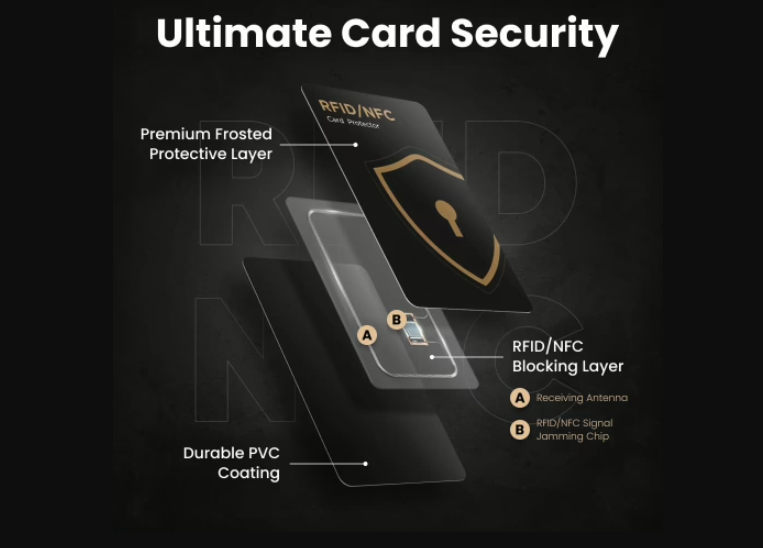

1. What is Credifence Card Protection?

Credifence Card Protection is a comprehensive financial safety service designed to protect individuals against card-related risks, fraud, loss, and misuse. It functions as a protective layer between you and potential financial threats by offering security services, assistance, and insurance coverage.

The service typically covers all types of cards, including:

-

Credit cards

-

Debit cards

-

Prepaid cards

-

ATM cards

By enrolling in Credifence Card Protection, customers can rest assured that even in the event of card theft, loss, or cyber fraud, their finances remain safeguarded through quick blocking services, emergency assistance, and monetary reimbursement (subject to terms).

2. Why Card Protection Matters Today

The importance of card protection cannot be overstated. The modern economy is heavily dependent on digital transactions, which makes cards an essential part of our lives. At the same time, they are lucrative targets for cybercriminals.

Some alarming statistics on card fraud:

-

Global losses due to card fraud exceeded $32 billion in 2022, with projections expected to rise annually.

-

Online scams, phishing attacks, and card skimming have become more sophisticated, often leaving customers unaware until it’s too late.

-

Victims of fraud often face stressful recovery processes, ranging from blocking cards to proving unauthorized transactions and waiting for refunds.

Credifence Card Protection addresses these challenges by ensuring customers don’t have to go through the ordeal alone—it offers immediate help, financial reimbursement, and identity protection.

3. Key Features of Credifence Card Protection

Here are the major features that make Credifence Card Protection stand out:

3.1 Centralized Card Blocking Service

Losing a wallet with multiple cards can be a nightmare. Credifence provides a one-call card blocking service, which immediately blocks all registered cards across banks to prevent unauthorized usage.

3.2 Coverage for Fraudulent Transactions

It offers insurance coverage against unauthorized transactions on lost or stolen cards. Whether it’s ATM withdrawals, online purchases, or POS transactions, protection ensures you don’t suffer financial losses.

3.3 Lost Wallet Assistance

Apart from blocking cards, Credifence also helps in replacing lost cards, arranging emergency funds, and guiding you through the entire process.

3.4 Emergency Cash Advance

If you’re traveling and lose your wallet, Credifence can arrange an emergency cash advance to help you continue your journey without financial stress.

3.5 Global Coverage

Credifence services aren’t restricted by borders. Whether you lose your card locally or internationally, assistance is available 24/7 worldwide.

3.6 Identity Theft Protection

In case of identity theft attempts (where fraudsters use your personal or financial information for unauthorized activities), Credifence helps with monitoring, alerting, and restoring your identity.

3.7 Complimentary Insurance Benefits

Many card protection plans include insurance for travel tickets, hotel bookings, or fraudulent mobile wallet transactions, extending beyond just physical cards.

4. Benefits of Choosing Credifence Card Protection

Enrolling in this service comes with a wide range of advantages:

4.1 Peace of Mind

The biggest benefit is psychological relief. Knowing that your finances are safe in the event of theft or fraud allows you to use your cards freely without constant fear.

4.2 Quick Resolution of Emergencies

Without protection, losing multiple cards means contacting each bank individually—a time-consuming task. With Credifence, one call is all it takes to block all cards instantly.

4.3 Financial Security

The reimbursement of fraudulent transactions means you don’t bear the financial brunt of criminal activity. This safety net is invaluable in today’s world.

4.4 Global Support

For frequent travelers, Credifence is particularly beneficial since it provides support even when you’re abroad—where resolving financial issues could otherwise be complicated.

4.5 Enhanced Trust in Digital Payments

By ensuring that risks are mitigated, card protection services encourage people to adopt digital payments confidently, which is crucial in an increasingly cashless economy.

5. How Credifence Card Protection Works

The functioning of Credifence Card Protection can be summarized in three main steps:

-

Enrollment

Customers register their credit, debit, and other cards with the service. This typically involves providing details of all the cards you want to protect under one account. -

Emergency Management

In case of card loss, theft, or suspicious activity, the customer calls the Credifence helpline. The team immediately blocks all registered cards and initiates protection measures. -

Reimbursement & Assistance

If fraudulent transactions have already taken place, a claim can be raised. Subject to terms and limits, customers are reimbursed for financial losses. Additional support like lost wallet assistance, emergency cash, and identity restoration is also provided.

6. Who Should Consider Credifence Card Protection?

While everyone who owns a debit or credit card can benefit, certain groups find it particularly valuable:

-

Frequent Travelers – People traveling internationally are at higher risk of card theft or loss.

-

Online Shoppers – Those who frequently use cards for e-commerce are vulnerable to cyber fraud.

-

Busy Professionals – Individuals who want a hassle-free solution for blocking and managing multiple cards.

-

Elderly Customers – Senior citizens may find it challenging to deal with multiple banks in case of fraud, so protection simplifies the process.

-

Families – Many plans allow protection for family members’ cards under a single subscription.

7. Comparing Credifence with Other Protection Services

Several financial institutions and third-party providers offer card protection services, but Credifence distinguishes itself in the following ways:

-

Centralized Card Blocking across all banks.

-

Global 24/7 Helpline support.

-

Emergency Cash Assistance while traveling.

-

Identity Theft Resolution services.

-

Comprehensive Insurance with wider coverage compared to basic bank-offered protection.

While some banks provide limited protection for their own cards, Credifence goes further by covering multiple cards and offering international assistance.

8. Real-Life Scenarios Where Credifence Can Help

To better understand the importance of card protection, let’s look at some practical scenarios:

-

Scenario 1: Lost Wallet in a Foreign Country

Imagine losing your wallet during a business trip abroad. With Credifence, you can instantly block all cards, receive emergency cash, and continue your trip without panic. -

Scenario 2: Online Fraudulent Transactions

Suppose your card details are stolen through phishing and unauthorized transactions are made. Credifence covers the financial loss, investigates, and helps you restore control. -

Scenario 3: Skimming at an ATM

If criminals skim your card and withdraw money fraudulently, the reimbursement coverage ensures you’re not left bearing the loss. -

Scenario 4: Elderly Parent’s Card Misuse

If your parents’ card is stolen and misused, you can manage the situation easily through Credifence, rather than them dealing with multiple banks.

9. Tips to Maximize Your Card Protection

While Credifence offers robust coverage, customers should also practice safe financial habits:

-

Never share PINs or OTPs with anyone.

-

Regularly monitor account statements for unauthorized transactions.

-

Use secure payment gateways when shopping online.

-

Enable transaction alerts via SMS or email.

-

Report card loss immediately to minimize risk.

Protection services like Credifence are most effective when combined with responsible financial behavior.

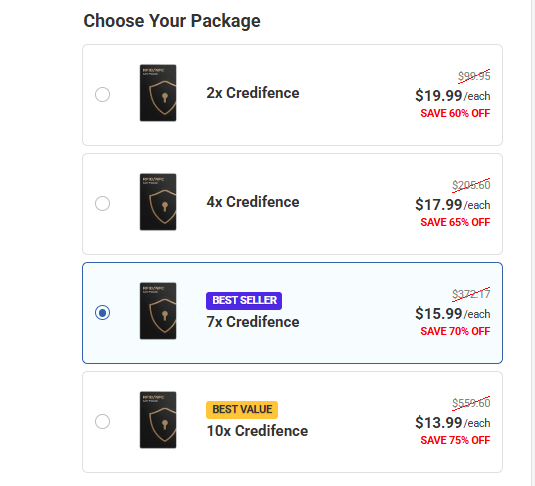

10. How to Enroll in Credifence Card Protection

Enrolling in Credifence is simple:

-

Visit the official website or partner bank/insurance provider.

-

Choose a plan based on your needs (individual or family).

-

Register your cards by providing details.

-

Pay the subscription fee (annual or monthly).

-

Receive your membership details, helpline numbers, and policy documents.

Most services activate immediately upon enrollment, meaning your cards are protected right away.

11. Frequently Asked Questions (FAQs)

Q1. Does Credifence cover online fraud?

Yes, it covers unauthorized online transactions made using your lost or stolen card details.

Q2. Can I register multiple cards?

Absolutely. You can register all your debit, credit, and prepaid cards under one membership.

Q3. Is there an age limit for membership?

Generally, there is no strict age limit, but applicants must be legal adults. Family plans may extend coverage to dependents.

Q4. How much reimbursement can I get?

Coverage limits vary depending on the plan. Typically, reimbursement can range from a few thousand to several lakhs.

Q5. What if I lose my wallet abroad?

You can call the 24/7 global helpline to block cards, request emergency cash, and receive assistance.

12. Conclusion

In a world where card fraud is on the rise, Credifence Card Protection offers a powerful solution to secure your finances. With features like centralized blocking, global assistance, insurance against fraud, and identity theft protection, it ensures you never face financial uncertainty alone.

Whether you’re a frequent traveler, an online shopper, or simply someone who values peace of mind, Credifence provides a safety net that allows you to use your cards with confidence.

Ultimately, protecting your financial health is just as important as safeguarding your physical health. By investing in Credifence Card Protection, you take a proactive step towards a safer, worry-free financial future.

![Zanari CBD Gummies Reviews [NEWEST UPDATE] Every USA Customer Must Know Before Spending!!! Zanari CBD Gummies Reviews [NEWEST UPDATE] Every USA Customer Must Know Before Spending!!!](https://bingnews24x7.com/wp-content/uploads/2025/10/Golden-Fountain-Farms-CBD-Gummies-150x150.png)

![Green Nature Farms CBD Gummies Reviews [Website Fact Check!] Know The Truth Before Buying! Green Nature Farms CBD Gummies Reviews [Website Fact Check!] Know The Truth Before Buying!](https://bingnews24x7.com/wp-content/uploads/2025/09/Golden-Fountain-Farms-CBD-Gummies-150x150.png)

Average Rating