Sydney, Australia, 2023:- According to brand-new CBRE information, leading end commercial transactions have been most impacted by the slow-down in investment activity in 2023, with the smaller-sized end of the marketplace verifying to be extra durable.

CBRE’s H1 2023 In and Out Record highlights that complete investment quantities visited 50% to $8.8 billion in the initial six months of this year, contrasted to the same duration in 2022. This consists of approximately $2.3 billion worth of deals that are yet to resolve, with a number based on capital raising.

Nevertheless, while deal quantities dropped across the board, there was a significant differential between the drop in sub-$ 100 million transactions, at 36%, and the 58% autumn tape-recorded for deals over $100 million.

CBRE’s Head of Capital Markets Research Tom Broderick said, “The smaller sized end of the marketplace has been more resilient, with exclusive purchasers seeing the current conditions as a possibility to buy properties while bigger institutional groups are largely on the sidelines.

CBRE Pacific Head of Capital Markets Flint Davidson also noted, “Possession dimension is presently the single greatest aspect figuring out purchaser depth on Australian sale campaigns. Over $200 million, you see the rate of interest begin to slim whereas scalable transactions were a priority 18 months ago. There is still significant liquidity waiting to see pricing revert and financial debt markets secure specifically for bigger assets. In overseas markets like Korea, where the interest rate cycle has peaked, buyer depth has returned so the market will certainly be carefully enjoying rates of interest motions.”

CBRE’s evaluation of the Australian commercial deals settled in H1 highlights that the office sector tape-recorded the highest possible quantity of transactions at $1.89 billion, complied with by retail at $1.83 billion.

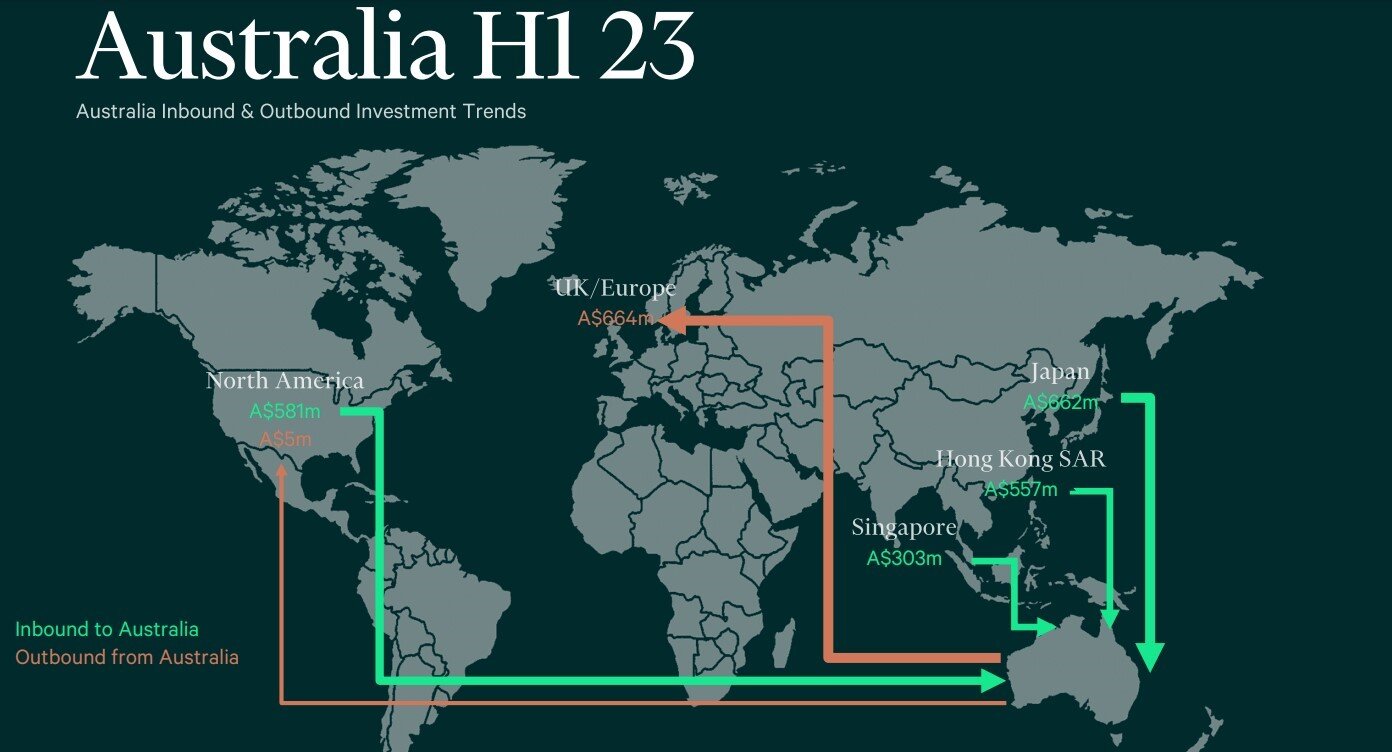

Offshore customers represented simply 24% of the H1 sales volume, below 44% over the same period in 2022. This converted to $2.1 billion in overall H1 2023 transactions, down 73% y-o-y, with the most considerable offer being Kong Kong-based exclusive equity group PAG’s acquisition of 44 Market Road for $393 million.

While general quantities were significantly down, CBRE’s report does highlight a noticeable rise in purchases by Japanese capitalists, who have acquired a competitive advantage because of reduced interest rates in Japan

From an outbound perspective, straight investment dove 87% to $669 million about the very same period in 2022.

“Adhering to increased Australian investment into Asia Pacific markets in the last few years, domestic teams, especially huge institutional investors, have ended up being cautious in the present atmosphere regarding acquiring properties directly as pricing re-calibrates around the world,” Mr. Broderick claimed.

Europe was the vital destination for Australian funding in H1 2023, with the Netherlands one of the most favored countries, accounting for 36% of overall external straight investment in H1 2023, adhered to by the UK.