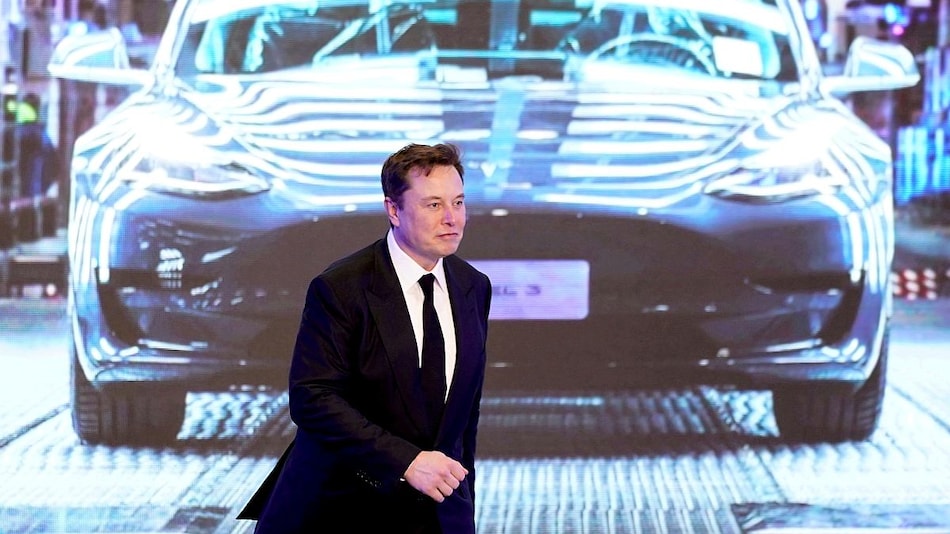

Elon Musk’s license to print money off , But Look For Integrated Plays?

New York, USA:- Elon Musk says there’s big money to be made by turning raw lithium into battery chemicals, but reducing profit margins suggest the mining end of the business may still be a much better wager. Musk last month described lithium refining as the difficult component in the intricate process of getting resources out of the ground and into Tesla Inc.’s autos. For those that can break it, it’s a “license to publish money,” he said. And also, he was right: margins did spike previously this year, as thriving orders from carmakers drove a document rise in prices for the specialty chemicals produced by “vendor refiners”– business that acquisition and also process product from lithium manufacturers.

But the refiners’ earnings can promptly perish if the cost of raw materials rises faster than the rate of the lithium chemicals they market. While China’s Covid lockdowns have actually weighed on demand for ended up items from battery- and automakers in current months, the rate of mined raw materials has actually continued to surge.

Consequently, profit margins at lithium plants have actually toppled. CPUs are still producing historically solid incomes, yet margins have actually dropped by more than half from a March peak, according to Fast markets, which tracks prices for lithium items as well as other commodities.

The turnaround is a pointer of how refiners– as well as the entire electric-vehicle supply chain– go to the grace of the miners and also their ability to induce brand-new manufacturing quickly enough to meet spiraling demand. Delayed supply responses are widespread in various other commodities markets, which is why the lion’s share of earnings are normally made in mining, not refining.

” Seller refining can be an attractive dreadful area to be in any commodity market, because you can get squeezed at both ends,” claimed Peter Hannah, an elderly price advancement manager at Fast markets. “I don’t assume these margins will be a lasting feature of the marketplace.”

Producers, meanwhile, continue to make big. Chile’s SQM, the second-largest supplier, reported record quarterly revenue late Wednesday and also claimed it expects prices will stay high via the rest of the year.

While Musk’s remarks have actually propelled lithium refiners into the spotlight, Tesla as well as other carmakers are significantly sharp to the threat of a long-term mine-supply crunch. Carmakers consisting of Ford Motor Co. and also General Motors Co. have been authorizing a flurry of long-term supply bargains for battery metals in current months with both miners and also processors, as increasing costs underscore the risk that EV development plans might stall without access to appropriate resources.

In an approach that goes against the grain of the sector’s standard just-in-time procurement practices, they’re currently progressively striking manage miners straight, also in cases where the projects are years away from production.

” There’s no absence of lithium, however there simply aren’t enough jobs that will certainly be up and running in time to meet need in that time frame,” said Max Reid, a battery resources analyst at Wood Mackenzie. “We’re fairly confident that there will certainly be a shortage opening in 2030 due largely as a result of lack of new financial investment in the very early days of this years.”

Tesla has actually led the charge in changing the sector’s approach to sourcing, also acquiring mining civil liberties in Nevada in 2020.

With costs for lithium chemicals holding at sky-high levels as well as mined resources referred to as spodumene continuing to surge, Musk has actually meant more forays– presuming regarding supply a demand to the industry on a capitalist call last month.

“If our vendors do not resolve these problems, then we will,” he said.

Average Rating