Rents Across U.S. Rise above $2,000 a Month For The First Time Ever 2023!

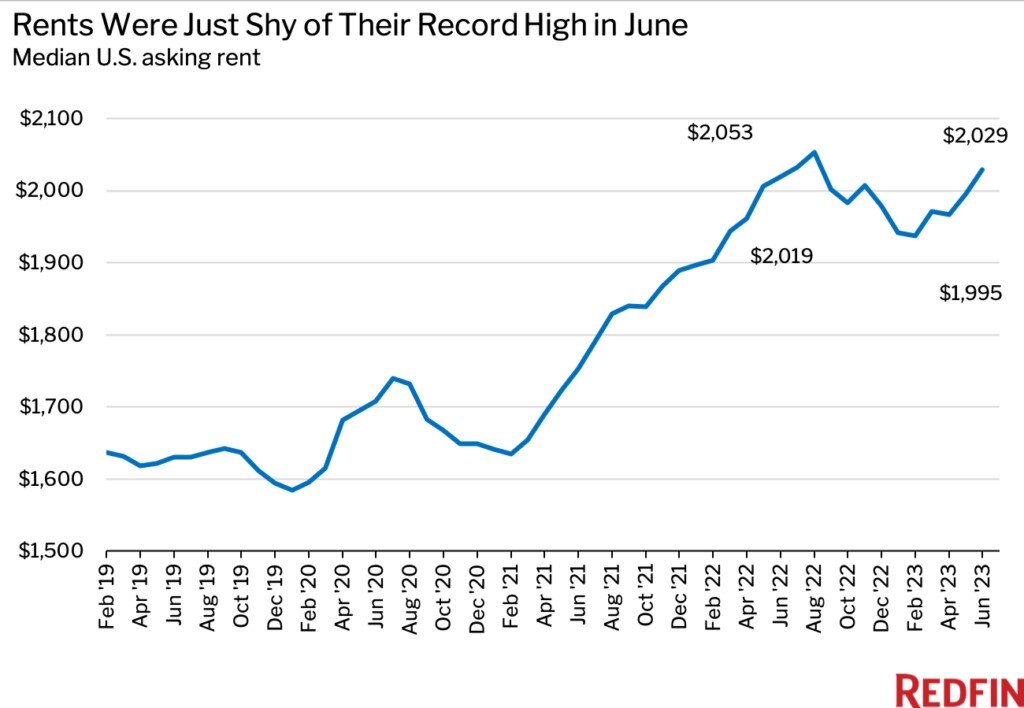

𝐍𝐄𝐖 𝐘𝐎𝐑𝐊, 𝐔𝐒𝐀, 𝟐𝟎𝟐𝟑:- National property broker Redfin is reporting that the U.S. residential rental market has been slowing down for greater than a year, however, the mean asking lease in June 2023 is still only $24 below its document high. The median asking rental fee was $2,029 in June, little changed from $1,995 one month earlier, $2,019 one year previously as well as a document high of $2,053 embedded in August 2022.

In portion terms, rental fees were up 0.5% year over year in June, not far from May’s 0.6% yearly decrease. Rental fees climbed 1.7% from one month earlier in June.

” The housing market tends to be ‘drawback sticky,’ which implies leas do not typically drop much even when occupant demand pulls back,” Redfin Deputy Chief Economic expert Taylor Marr claimed. “Rather than lowering rental fees when business is slow, many property owners offer benefits like a complimentary month’s lease or marked down auto parking, which tends to be less of a hit to profits.”

Marr proceeded: “The steep slowdown in rent growth over the last year is giving some alleviation for occupants, that now have much more area to discuss as their proprietors come to grips with increasing jobs. But with rental fees near their document high, most renters still aren’t locating big deals.”

Slowing Lease Growth Is Ultimately Making a Dent in the Rising Cost Of Living; Rents and also Rising Cost Of Living Have Area to Fall

While the dropoff in lease development hasn’t made huge damage for many occupants, it has aided reduce the historical inflation tormenting U.S. customers, according to data launched today. Customer costs were up 3% this year through June, a deceleration from the 4% number reported in Might and the top of about 9% last summertime. The price of shelter, which generally includes a rental fee, increased 0.4% from a month previously in June on a seasonally readjusted basis– a considerable cooling from 0.8% at the end of last year. The rising cost of living data generally delays Redfin’s rental data, so the downturn in the rising cost of living reported today is in large part a result of the slowdown in rent development over the past year.

” Inflation needs to proceed to alleviate this year as well as right into 2024, partly since the recent slowdown in rental fee growth isn’t fully baked into the rising cost of living data yet, as well as partly because leas have room to drop,” claimed Redfin Economics Research Lead Chen Zhao. “Leas have room to come down since there continues to be a backlog of under-construction leasings that have yet to hit the market, which means landlords will certainly continue facing jobs as well as will not be able to hike leas as rapidly.”

Rental fee growth has cooled from its 2022 high partially since fewer individuals are moving because of financial unpredictability and also slowing household formation, as well as partially because the variety of options renters can select from has surged. Finished domestic jobs in structures with 5 or even more devices rose 23.9% year over year to 493,000 on a seasonally changed basis in May– the most current month for which information is available– which indicates landlords have a lot more vacancies to load and also less flexibility to increase rates.

While a homebuilding boom has led to more leasings in the marketplace, the boom is alleviating. The number of permitted property projects in structures with five or even more systems dropped 12.2% year over year to 540,000 on a seasonally-adjusted basis in May. Permits, or approvals given by local territories to begin construction projects, are a leading indicator of what’s taking place in the real estate market. Conclusions are a lagging indicator.

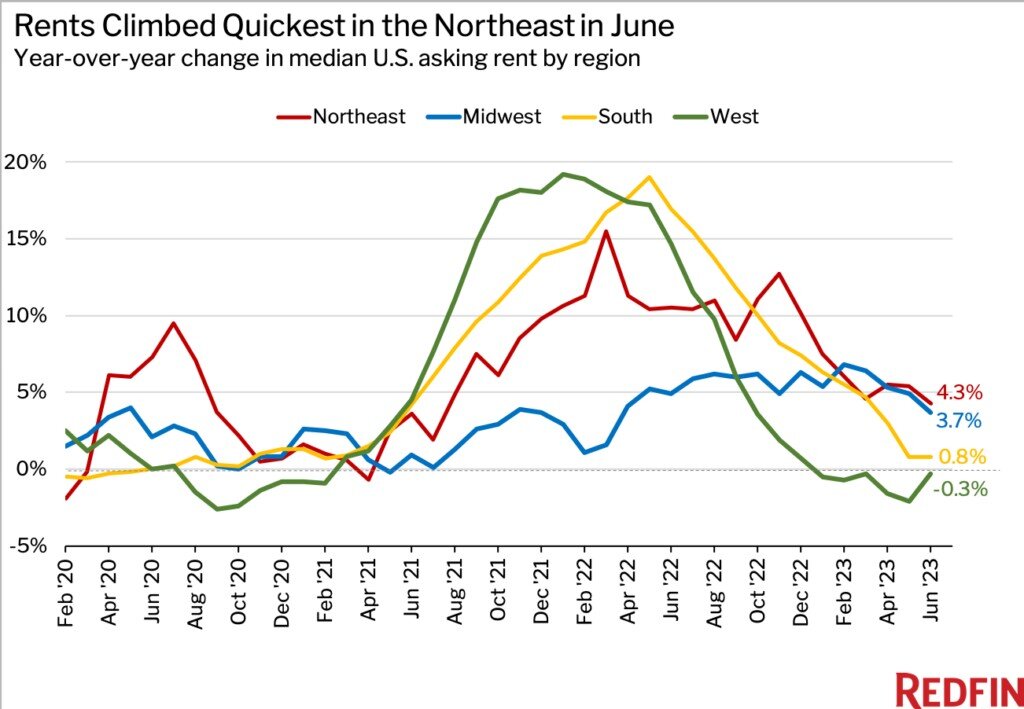

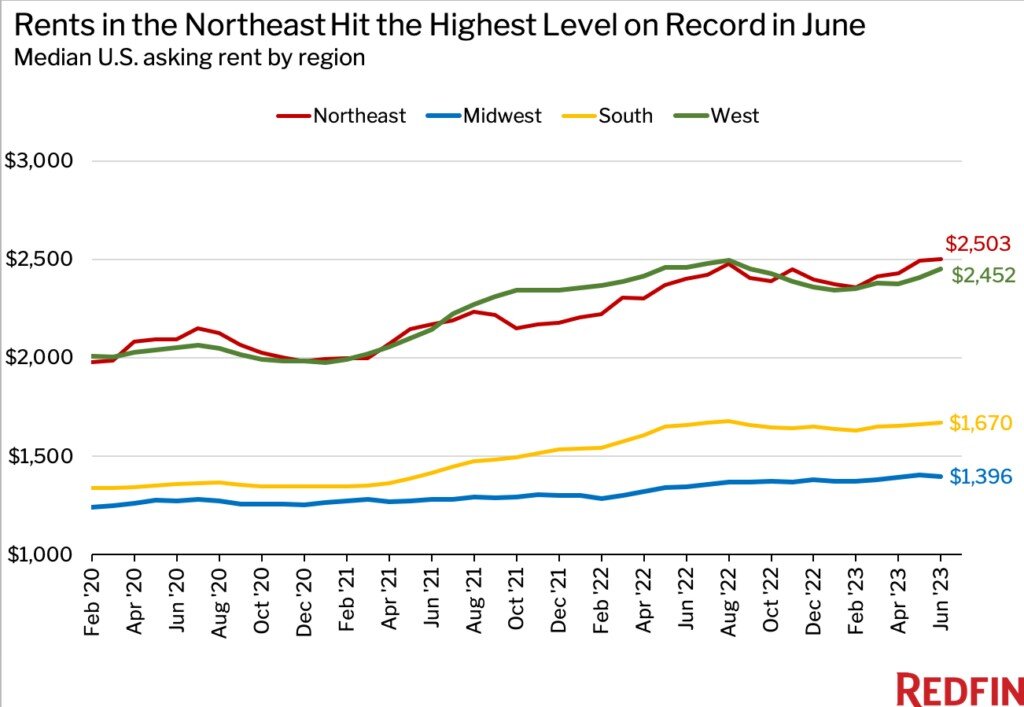

Rental Fees Are Rising Fastest in the Northeast as well as Midwest

In the Northeast, the median asking lease climbed 4.3% year over year to a record $2,503 in June. By comparison, asking rental fees increased 3.7% to $1,396 in the Midwest, 0.8% to $1,670 in the South, and also fell 0.3% to $2,452 in the West. While leas continued climbing throughout much of the U.S., lease growth was far listed below its optimal in most of the nation.

Rent development has been slowing down fastest in the West as well as the South partly since it accelerated so rapidly throughout the pandemic as individuals swamped into Sunlight Belt cities including Phoenix, Miami, and Dallas. Now, rental fees in those regions have more room to cool as supply catches up with demand.

But while leas have dipped from a year ago in some areas, budget-friendly deals are still commonly tough to come by.

” The headings claim San Francisco’s housing market is plummeting, but I’m still seeing people moving in and also spending $4,000 a month on the lease,” stated regional Redfin agent Ali Mafi. “A lot of tech workers who left the Bay Location for areas like Austin throughout the pandemic are now coming back because their employers cut their pay when they relocated and/or have asked them to come back to the office.”

Read Must Here:- Commercial Property Investment in Australia Dives 50 Percent in 2023-24?

Average Rating