𝐍𝐄𝐖 𝐘𝐎𝐑𝐊, 𝐔𝐒𝐀, 𝟐𝟎𝟐𝟑:- According to the most up-to-date Zillow Market Report, the normal U.S. home worth overshadowed $350,000 for the first time as healthy and balanced demand from customers continues to ram unwilling vendors.

” House customers have lingered this spring despite difficult affordability challenges and record-low inventory,” claimed Jeff Tucker, a senior economic expert at Zillow. “Demand commonly starts to relieve in the summertime, and there are signs that competition is subsiding, but big cost decreases are not likely till more homeowners detail their homes to offer for sale.”

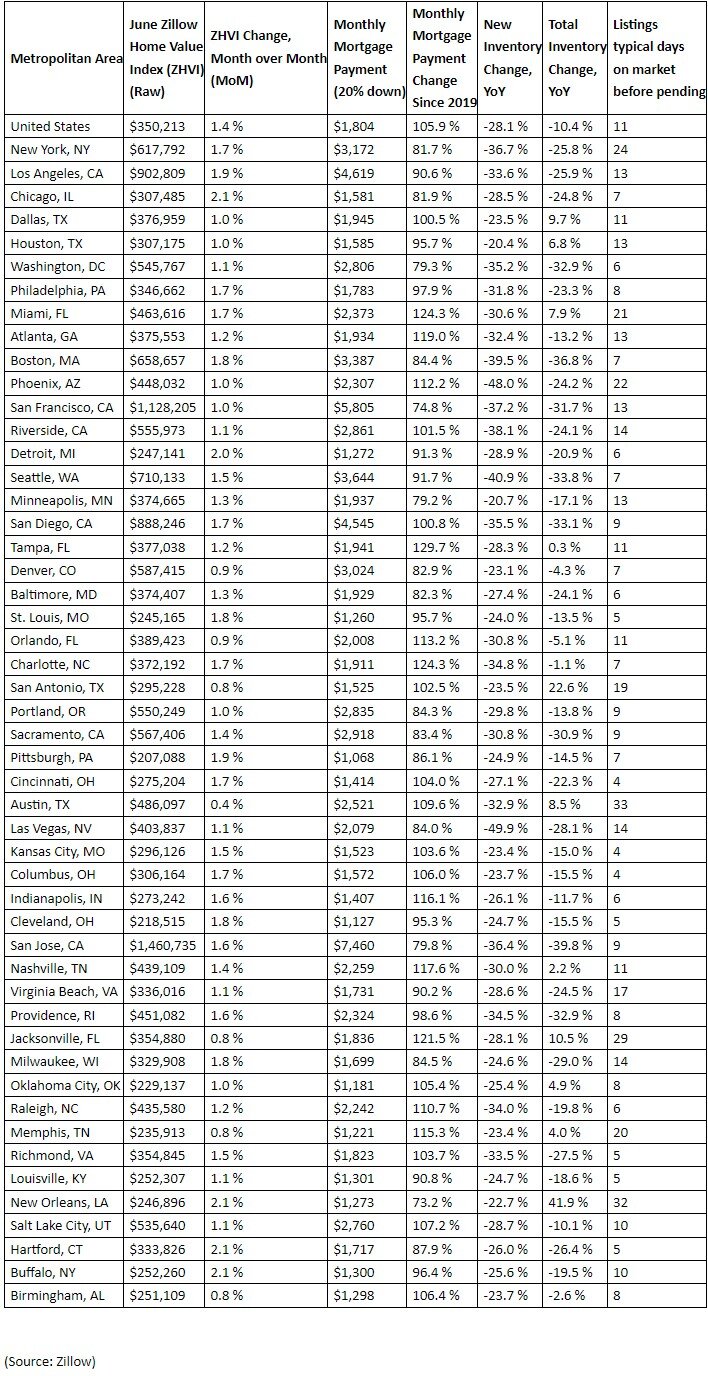

The typical U.S. house’s worth climbed up 1.4% from Might to June, proceeding a four-month warm touch. The brand-new height of $350,213 is almost 1% more than last June and hardly slips by the previous Zillow Home Value Index record embedded in July 2022.

From Locations to soft spots: Local residence value trends

Affordability remains the key to market strength, as lower-priced metro areas uploaded the largest regular monthly gains; Chicago, Buffalo, New Orleans, and Hartford all notched 2.1% regular monthly growth, with Detroit close behind at 2%. Those markets all have common residence worths lower than the national average.

As in May, house values climbed from the previous month in all 50 of the biggest metro locations. The slowest monthly growth remained in Austin (0.4%), complied with by Jacksonville, Memphis, San Antonio, and also Birmingham, which all saw 0.8% rises.

The drought of new listings intensifies

The flow of new homes available for sale ticked up 2.4% month over month, yet the annual shortage grew, now standing at 28% fewer listings than a year ago. June is typically one of the best months for fresh supply, but this year just 376,500 new listings arrived on the marketplace. That’s closer to levels seen in the slower months of February and October than to average brand-new listings in June (505,100), according to Zillow data getting back to 2018.

An absence of brand-new listings has dogged the real estate market for virtually a year, as well as higher home loan prices remain the primary suspect. Rates at 6.8% this week (the greatest given that November, up from 5.1% a year back and also 3% 2 years ago) make it especially costly for property owners– most of whom have a home loan well listed below today’s prices– to borrow for their next house acquisition.

An additional description could be that property owners are claiming greater prices. Residence values have progressively raised considering that January in much of the nation but continue to be listed below tops reached last summer in several markets.

” Maybe some homeowners have been waiting until rates set brand-new highs in their market before deciding to money in their chips,” Tucker claimed.

The overall swimming pool of existing homes offered for sale is less than any in June because of a minimum of 2018. It’s down 10% from 2014 and also an incredible 45% listed below June 2019.

The drop-off in demand implies much fewer competitors for buyers

Potential buyers can see some mild relief imminent, as a couple of metrics indicate need and competition are cooling. Sales determined by newly pending listings dipped almost 5% from May to June, adhering to seasonal trends seen in 2022 as well as before the pandemic, when accepted offers crested in May.

Listings likewise lasted much longer in June, 11 days before the common listing went pending, compared to 10 in Might. However, that’s still a much faster market than in 2019, when listings went pending in 21 days.

Rent growth is back to typical

Zillow’s latest monthly lease record reveals lease growth is back to pre-pandemic norms for this time of year, concerning 0.6% monthly. San Diego overtook San Francisco as the third-most-expensive place to rent out.

Don’t Miss:-Commercial Property Investment in Australia Dives 50 Percent in 2023-24?

Average Rating