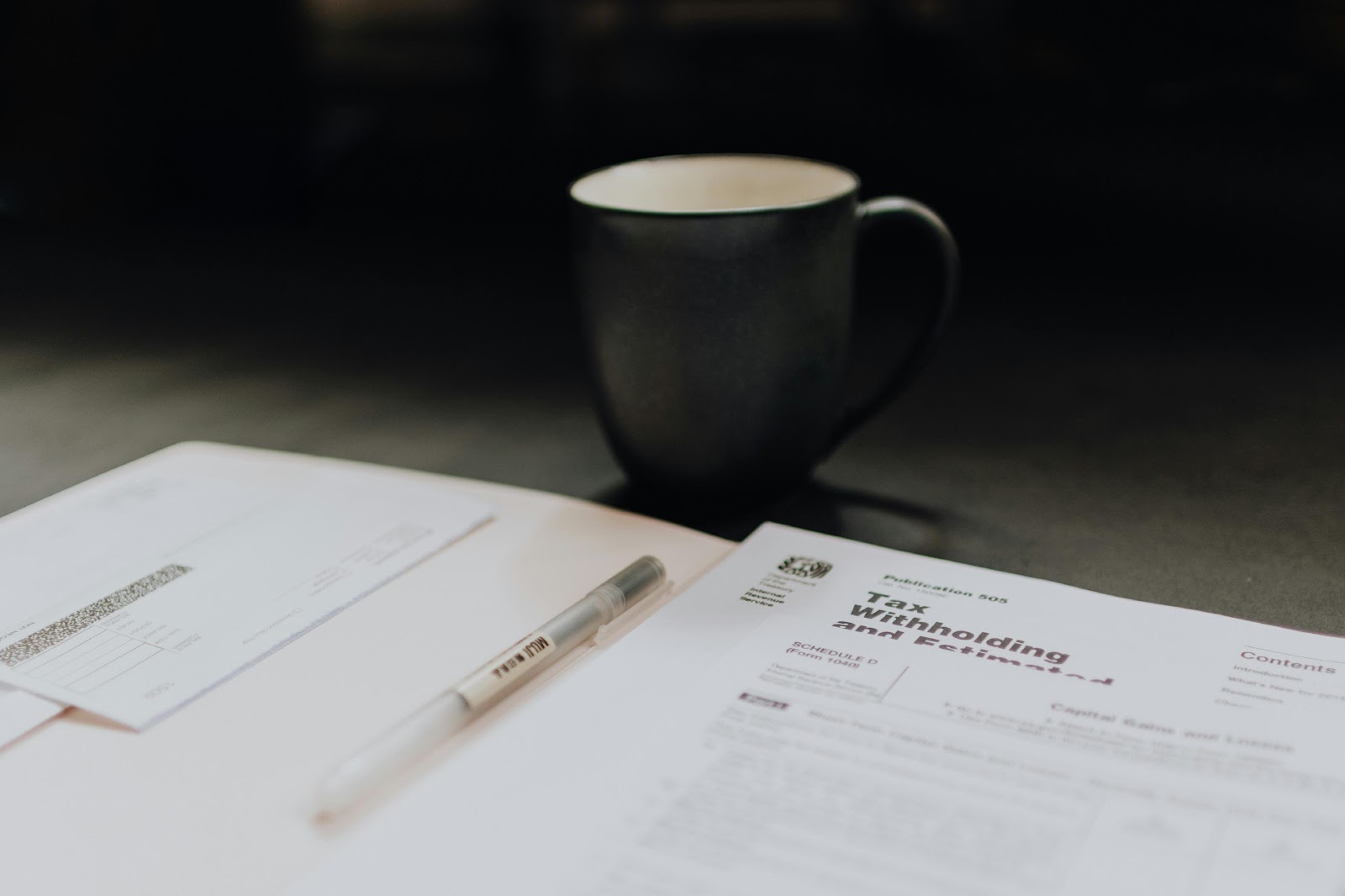

Property Tax Guide: Everything you Need to Know 2023

Whether you’re simply starting or have been buying realty for some time, there’s no denying that taxes can make the most experienced proprietor feel baffled and terrified. This overview will certainly give an introduction to the real estate tax for individuals brand-new to buying realty. It will certainly be a refresher course for seasoned landlords, allowing you to focus even more of your time on your house and less on paying tax obligations.

What’s property tax?

In San Antonio and other states, a tax obligation is imposed on certain sorts of physical residential property, such as real estate, land, and homes, known as property tax. The quantity of tax owed is established by the location and value of the residential property, and it is paid by the property owner. Neighborhood and state governments collect real estate tax to fund various neighborhood services such as road building and construction, police and fire protection, college areas, and various other social work. The local earnings company, commonly the area, sets the tax obligation price, which after increases in the value of the residential property establishes the tax obligation settlement. While “real estate tax” and “property tax” are often used mutually, some jurisdictions likewise impose property taxes on personal property, including automobiles, watercraft, planes, equipment, and livestock.

How is property tax computed?

The federal government gathers a cost on property, called property tax, which is computed based on the property’s value and paid every year. The amount of property tax a person has to pay differs depending on the territory they stay in, as each jurisdiction has its own set of regulations. The neighborhood property tax assessor establishes the building’s analyzed value, which is generally based on the building’s fair market price. The amount of property tax owed is determined by increasing the evaluated value by the regional tax obligation price. The local tax obligation price can be either a fixed price or a progressive rate, depending on the jurisdiction. Specific deductions, such as homestead, armed forces, and senior exceptions, can lower the property tax and the residential property’s examined value. Furthermore, buildings used for farming or possessed by not-for-profit companies might also qualify for minimized tax obligations.

It’s important to pay real estate tax completely and on schedule to prevent any kind of extra charges or fines. Real estate taxes are commonly separated into numerous installments due throughout the year, as determined by the local jurisdiction. Given that real estate tax plays a considerable role in financing local government operations, house owners must have a clear understanding of just how their tax obligation is computed to ensure they’re paying the correct quantity.

What happens as soon as you fall short of paying property taxes?

If you do not pay your real estate tax in San Antonio, the exhausting authority may place a tax obligation lien on your property. This indicates that the federal government has a legal case on your building and any economic possessions you possess now or in the future. It’s not always a seizure of your assets, but instead a claim on them. If you sell the property, the federal government may be qualified to a part or every one of the earnings. To stay clear of any surprises, buyers and vendors generally perform a title search to uncover any kind of tax obligation liens on the home.

The structure of a state’s property tax system might influence the state’s attract residents and ventures. Legislators must hence see to it that any kind of restriction regimes they adopt are effective and the state is staying clear of substantial personal property taxes and nonneutral split roll systems to the greatest extent possible.

![Zanari CBD Gummies Reviews [NEWEST UPDATE] Every USA Customer Must Know Before Spending!!! Zanari CBD Gummies Reviews [NEWEST UPDATE] Every USA Customer Must Know Before Spending!!!](https://bingnews24x7.com/wp-content/uploads/2025/10/Golden-Fountain-Farms-CBD-Gummies-150x150.png)

![Green Nature Farms CBD Gummies Reviews [Website Fact Check!] Know The Truth Before Buying! Green Nature Farms CBD Gummies Reviews [Website Fact Check!] Know The Truth Before Buying!](https://bingnews24x7.com/wp-content/uploads/2025/09/Golden-Fountain-Farms-CBD-Gummies-150x150.png)

Average Rating